When it comes to investing, one principle stands the test of time: diversification. It’s not just a buzzword in financial circles. It’s a strategy that can help you navigate the uncertainties of the market. But what does diversification actually mean, and why is it so frequently mentioned in the financial industry?

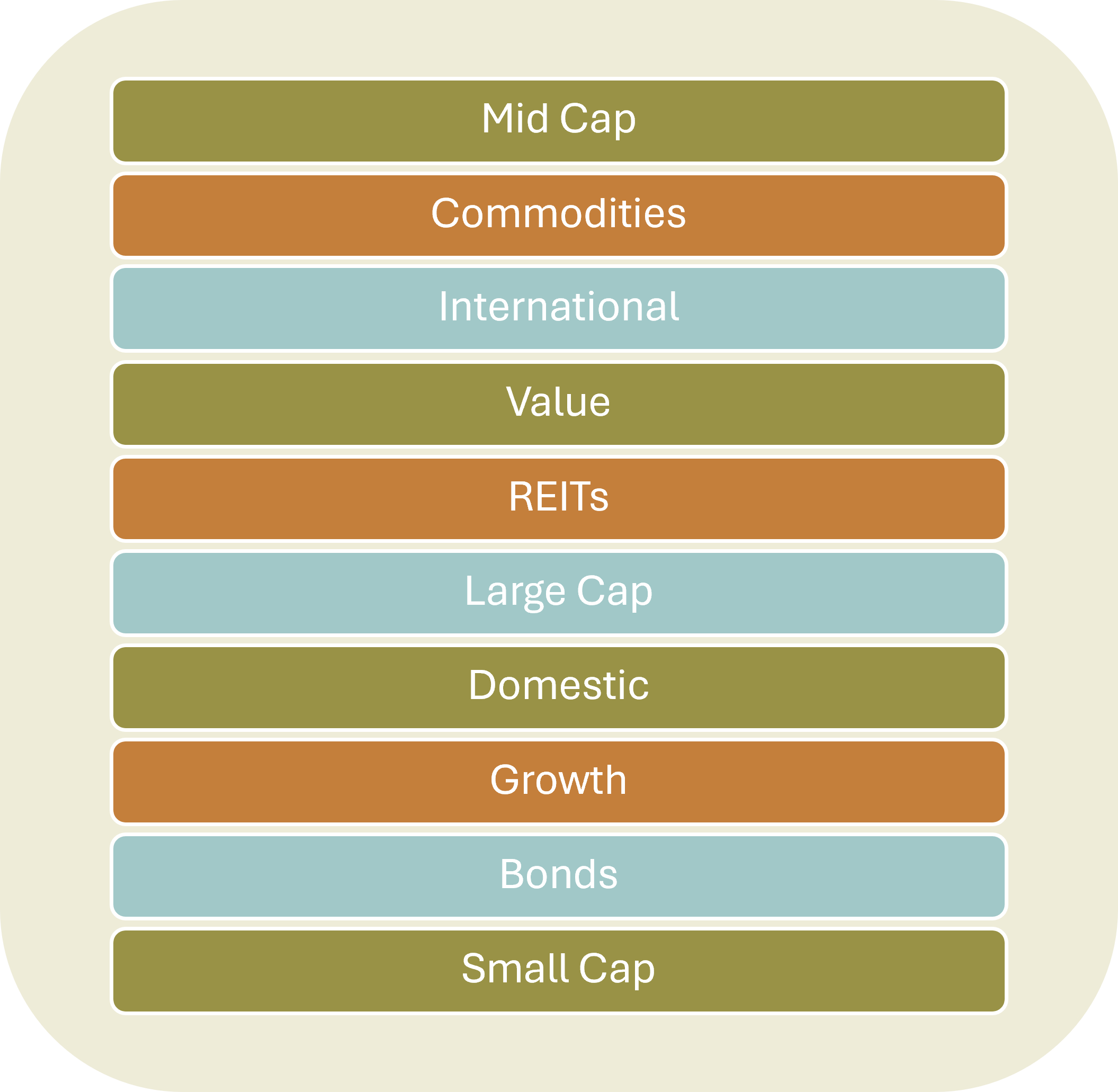

Diversification is the practice of spreading your investments across different asset classes, sectors, and geographic regions. The goal is simple: to reduce risk by avoiding overexposure to any single investment. A common metaphor that this draws parallel to is not putting all your eggs in one basket.

Markets are inherently unpredictable, but diversification can help mitigate the impact of a downturn in one area of your portfolio. For example, if your portfolio consists of three different investments—let's call them A, B, and C—and investment A experiences a decline, the other two investments, B and C, have the potential to behave differently. B and C might remain stable or even perform favorably, which could help offset the losses from A.

The benefits of diversification are best seen over time. Take, for example, a portfolio that is only invested in domestic small cap equities. In a hypothetical year when domestic small cap equities turn out to be a top performer, it could be tempting for an investor to continue investing her entire portfolio in solely domestic small cap equities. However, if that asset class ends up being the very bottom performer the next year or several years later (which has certainly happened to some asset classes before), additional asset class exposure could have helped minimize some of the downfall.

Diversification is not about chasing quick gains and it certainly doesn’t eliminate all risk. But by spreading your investments across various assets, you are more likely to better weather unpredictable market fluctuations and reduce the chance that all your eggs break at the same time.

This material is being provided for informational or educational purposes only. Those seeking information regarding their particular investment needs should contact a financial professional. The opinions expressed were current as of the date of posting but are subject to change without notice due to market, political, or economic conditions.